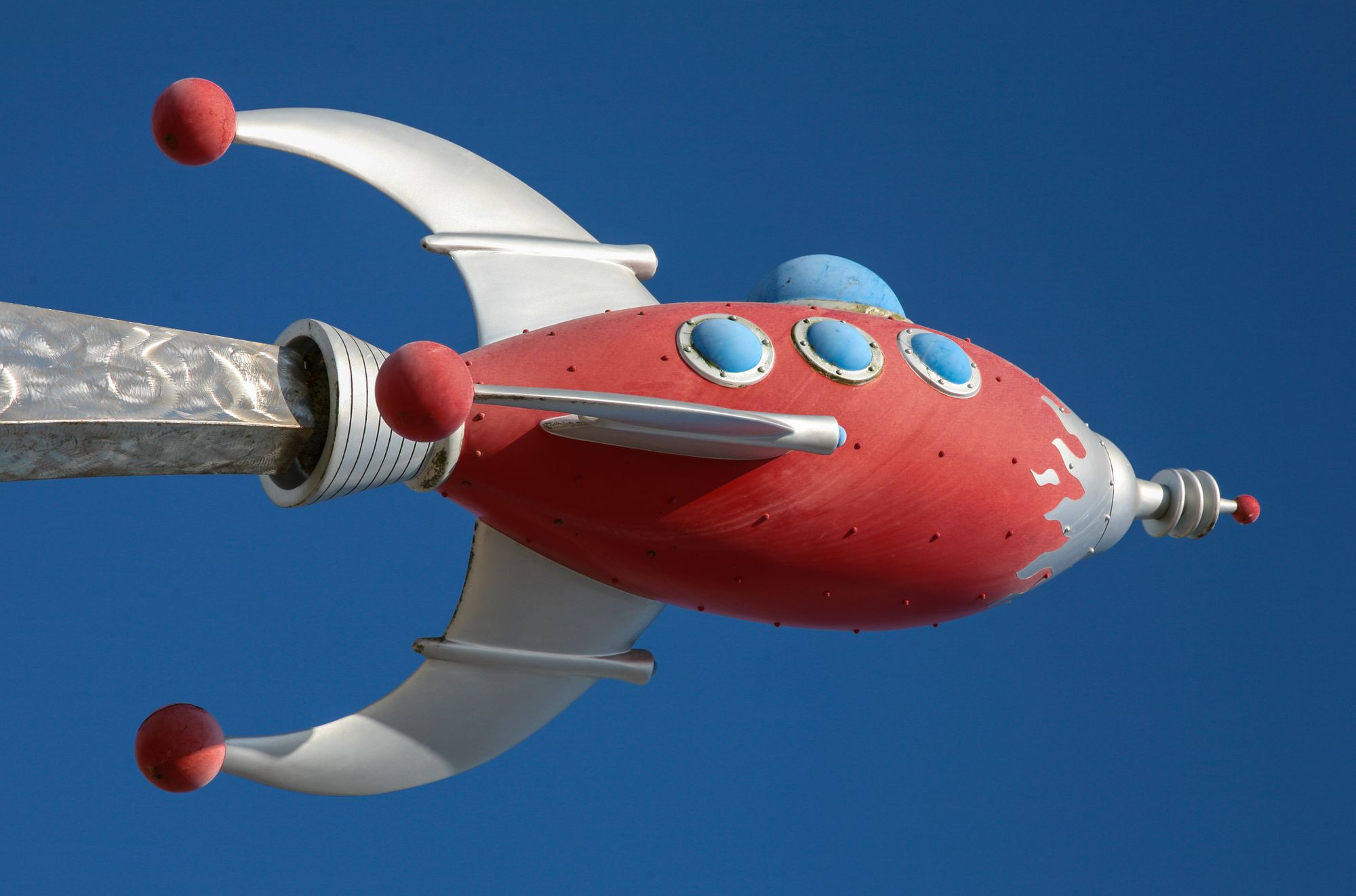

It's rocket science

“Founders at Work” is a unique book by Jessica Livingston, one of the founders of YCombinator. It contains un-narrated, almost unedited interviews with founders of successful startups like Paypal, Hotmail, Apple, and 27 others. I’m only through about 10% of the book, and it’s clearly one of the most valuable reads for a pre-product-market fit founder like myself.

Published in 2008, the book is old by internet standards, but somehow that adds to its value. Early stories about Hotmail or Paypal somehow feel simpler to take seriously than Facebook’s or Stripe’s, more recently started companies.

I can relate to these stories. Most books like that, including in-depth biographies of founders, paint a startup’s story as inevitable. In the fictionalized version, a company’s life flows smoothly through progress and setbacks, through some narrative that makes it impossible to imagine anything going otherwise. Observation: it’s clearly not going as well for me. Thus those stories make me suspect must be wrong with Taivo’s approach, even if there isn’t.

Livingston’s raw notes from founders are refreshing in their honesty. Paypal went through several iterations before building the product they are now famous for. Note how they started highly technology-driven and gradually took steps closer to consumers!

Livingston: Tell me about how you adapted the strategy.

Levchin: Initially, I wanted to do crypto libraries, since I was a freshly minted academic. "I won't even need to figure out how to do this commercialization part. I'm just going to build libraries, sell it to somebody who is going to build software, and I can just sit there and make a penny per copy and get marvelously rich very quickly." But no one was making the software because there was no demand. So we said, "We'll make the software." We went to enterprises and told them we were going to do this and got some positive reception, but then the thing happened again where no one really wants the stuff. It's really cool, it's mathematically complex, it's very secure, but no one really needed it.

By then we had built all this tech that was complicated and difficult to understand and replicate, so we thought, "We have all these libraries that allow you to secure anything on handheld devices. What can we secure? Maybe we can secure some consumer stuff. So enterprises will go away, and we'll go to consumers. We'll build the wallet application—something that can store all of your private data on your handheld device. So your credit card information, this and that." And we did, and it was very simple because we already had all the crypto stuff figured out. But, of course, there was no incentive to have a wallet with all these digital items that you couldn't apply anywhere. "What's my credit card number?" Pull out your wallet and look, or pull out your handheld wallet and look? So that was really not going to happen either.

Then we started experimenting with the question: "What can we store inside the Palm Pilot that is actually meaningful?" So the next iteration was that we'd store things that were of value and you wouldn't store in other ways. For example, storing passwords in your wallet is a really bad idea. If you store them in your Palm Pilot, you can secure it further with a secondary passphrase that protects it. So we did that, and it was getting a little bit of attention, but it was still very amateur.

Then finally we hit on this idea of, "Why don't we just store money in the handheld devices?" The next iteration was this thing that would do cryptographically secure IOU notes. I would say, "I owe you $10," and put in my passphrase. It wasn't really packaged at the user interface level as an IOU, but that's what it effectively was. Then I could beam it to you, using the infrared on a Palm Pilot, which at this point is very quaint and silly since, clearly, what would you rather do, take out $5 and give someone their lunch share, or pull out two Palm Pilots and geek out at the table? But that actually is what moved the needle, because it was so weird and so innovative. The geek crowd was like, "Wow. This is the future. We want to go to the future. Take us there." So we got all this attention and were able to raise funding on that story.

I like Levchin’s description because he’s very blunt about previous failures, but also because it implies an interesting pivot strategy. Imagine you’re building a technology (crypto libraries) for an imagined use case (securing enterprise software). It turns out the demand is not there. So, you step into the imagined customer’s shoes (enterprise B2B software companies) and build it yourself.

These interviews have also nudged me away from blind market empiricism. You can’t find a great product by merely extracting customer problems. It sounds naive, but in retrospect, some form of this belief has underpinned many of my early efforts to find what works.

The opposite would be to rely on a theory of why people will want your product. You clearly need both theory and data; the hard part is not letting the theory bias the data collection. That’s difficult in physical sciences and more so in social science. In the science of finding product-market fit, avoiding that bias — while still building theories and collecting data — is harder still.

I like the comparison between product-market fit and a valuable theory in science. Both appear in school or media as inevitable. If you don’t independently work out the basics of electricity, it seems so simple and straightforward to understand. That’s an illusion. It’s simple only because it’s already been solved.

It’s easy to look at a Google or a Stripe and explain their success, starting with the absolutely critical pre-school dance classes the founders received. Not so easy to build it yourself without the benefit of hindsight. That’s why I now have so much respect for startup founders, successful or not. Finding product-market fit is like being a rocket scientist — in 1850.